下游新订单减少,晶圆代工厂开始调整产品结构

分析师表示,前所未有的芯片需求盛宴已经结束。 尽管在2022年秋季苹果新iPhone发布的带动下,2022年第三季度全球前10大晶圆代工厂营收将增长6%,总营收将达到352.1亿美元 美元,但预计四季度形势不利。 乐观。 此前,TrendForce也预测,全球前10大晶圆代工厂在2022年第四季度的营收将下滑,原因是需求疲软导致芯片销量减少、库存增加。

该机构还表示,中国此前针对新冠的零清算政策、全球经济疲软和高通胀持续影响全球消费者信心。 因此,2022年下半年旺季需求将表现平平,半导体库存消耗将慢于预期。 这种情况也导致晶圆代工订单锐减。 持续两年的芯片需求热潮将在 2022 年第四季度正式结束。

值得注意的是,目前汽车市场仍存在芯片供应吃紧的问题。 麦肯锡报告称,汽车行业对90nm芯片的依赖将导致汽车芯片供需在一段时间内失衡。 但对芯片厂商不利的因素,未必对芯片采购商不利。 等待关键部件出货的终端产品制造商将看到紧绷的半导体供应链开始松动。

到目前为止,严峻的市场预测几乎没有影响到芯片制造商的业务。 计划建造新的晶圆厂。 《芯片法案》的通过 在美国推动了更多的晶圆厂到美国投资。 例如,台积电在亚利桑那州增加了第二家晶圆厂; 三星扩大了在德克萨斯州的投资; 美光宣布在纽约投资 此外,公司计划投资150亿美元在爱达荷州博伊西建设新工厂。

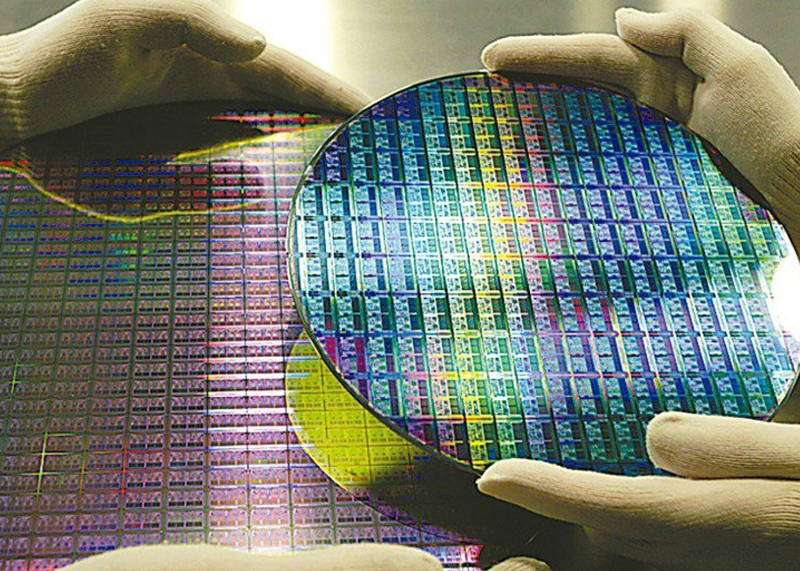

前10大晶圆代工厂占全球90%市场份额

2022年第三季度台积电、三星、联电、GlobalFoundries、中芯国际领跑全球晶圆代工市场增长,以营收计算,这五家公司总营收占全球晶圆代工市场的89.6% . 不过,TrendForce也注意到,2022年第三季下游客户减少库存及新订单活动。 具体表现如下:

台积电是苹果新iPhone主芯片的制造商。 由于新iPhone的库存需求旺盛,台积电2022年第三季度业绩增长明显,营收为201.6亿美元,环比增长11.1%。 推动这一增长的因素可归因于台积电在 7 纳米工艺节点内(包括 7 纳米工艺节点)的芯片。 此类芯片的收入占台积电总收入的比例一直在上升,2022年第三季度达到54%。

尽管三星也为新的 iPhone 系列提供组件,但三星 2022 年第三季度的代工业务收入环比微跌 0.1%,并且由于韩元大幅走软,三星代工业务收入环比微跌 0.1%。 的市场份额下降到 15.5%。

联电2022年第三季度营收约为24.8亿美元,环比增长1.3%。 联电一季度业绩主要受美元走强和28nm新增产能带来的提振因素影响。

GlobalFoundries的 季度收入增长 4.1% 至约 20.7 亿美元。 这一增长归因于晶圆出货量的环比增长,以及晶圆ASP(平均售价)和产品结构的进一步优化。 此外,GlobalFoundries一直保持着90%以上的产能利用率。

中芯国际2022年第三季度营收约为19.1亿美元,环比微增0.2%。 中芯国际的产品结构偏向于消费电子芯片,因此公司第三季度业绩持平。 尽管如此,中芯国际2022年第三季度的营收仍在攀升,受益于晶圆ASP的优化抵消了产品结构和晶圆出货量下降的影响。

下游改单对晶圆代工厂的影响

TrendForce报告还称,美国的出口管制令中芯国际的客户对增加晶圆投资变得更加犹豫。 然而,在此背景下,中芯国际将其 2022 年的资本支出从最初的 66 亿美元提高了 32%